Multiple Choice

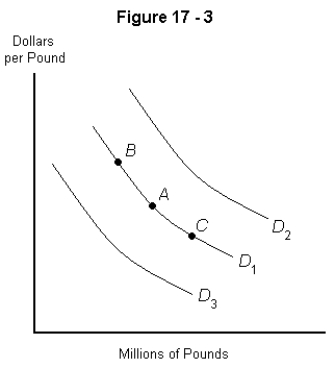

-Refer to Figure 17-3 above figure,where the current demand curve is D₁.Suppose interest rates in England drop relative to those in the United States.Which of the following would happen?

A) The U.S.would move from point A to point B along D₁

B) The U.S.demand curve for British pounds would shift from D₁ to D₂

C) The U.S.demand curve for British pounds would shift from D₁ to D₃

D) The U.S.would move from point A to point C along D₁

E) The U.S.would move from point C to point B along D₁

Correct Answer:

Verified

Correct Answer:

Verified

Q25: If U.S.GDP drops and South Korean GDP

Q26: Which of the following is a reason

Q27: If British tastes changed so that Britons

Q28: If the U.S.inflation rate is 3 percent

Q29: The concern of economists with respect to

Q31: To an American,the demand curve for euros

Q32: Suppose that British tastes changed and American

Q33: Under a managed float,if U.S.GDP suddenly increased,which

Q34: Which of the following would lead to

Q35: The hard-landing scenario begins with<br>A) a US