Multiple Choice

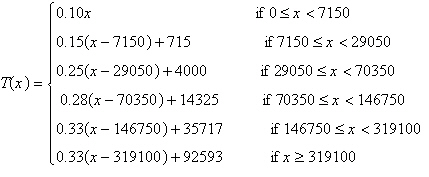

The amount of federal income tax  an individual owed in 2004 is given by

an individual owed in 2004 is given by  where x is the adjusted gross income tax of the taxpayer. What is the domain of this function? Write answer in interval notation.

where x is the adjusted gross income tax of the taxpayer. What is the domain of this function? Write answer in interval notation.

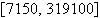

A)

B)

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: Determine whether the following scatter diagram suggests

Q4: Use the graph of E, shown below,

Q5: A rental car company purchases an automobile

Q6: An air freight company has determined that

Q7: The table below gives the wingspan, in

Q9: For the piecewise-defined function below, find <img

Q10: Graph the following equation by plotting points

Q11: The sum of the length l and

Q12: Evaluate the following composite function if <img

Q13: A boat was purchased for $39,000. Assuming