Multiple Choice

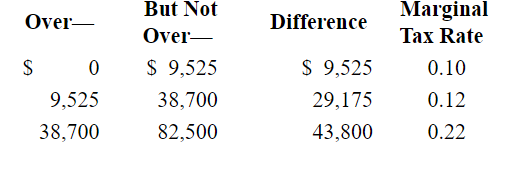

Following is a partial personal taxable income schedule for a single filer:  What would be the dollar amount of income taxes paid by a single filer who has taxable income of $9,525?

What would be the dollar amount of income taxes paid by a single filer who has taxable income of $9,525?

A) $952.50

B) $1,143.00

C) $3,501.00

D) $4,453.00

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Service marks refer to services such as

Q27: Which of the following business organizational forms

Q28: Based on 2018 tax schedules, the first

Q29: An employment contract is an agreement between

Q30: Which of the following is not a

Q32: Which of the following are intellectual property

Q33: Beginning in 2018, the income tax laws

Q34: Certification marks are typically used to:<br>A)indicate membership

Q35: Business angels typically invest in:<br>A)early-stage ventures<br>B)rapid-growth stage

Q36: The total dollar amount of federal income