Multiple Choice

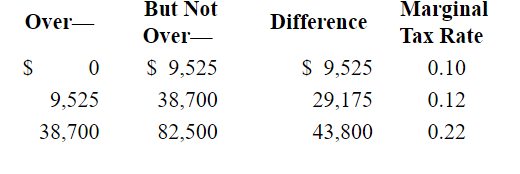

Following is a partial personal taxable income schedule for a single filer:  What would be the maximum dollar amount of income taxes in the $38,700-$82,500 bracket paid by a single filer with taxable income of $82,500?

What would be the maximum dollar amount of income taxes in the $38,700-$82,500 bracket paid by a single filer with taxable income of $82,500?

A) $952.50

B) $3,501.00

C) $4,453.50

D) $9,636.00

Correct Answer:

Verified

Correct Answer:

Verified

Q48: Patent trolls are firms authorized by the

Q49: An idea is enough to be patented.

Q50: Which form of business organization is characterized

Q51: Which of the following numbers of shareholders

Q52: The total dollar amount of federal income

Q54: Trade secrets are intellectual property rights in

Q55: The difference between a limited partnership and

Q56: The Leahy-Smith America Invents Act of 2011

Q57: Business method patents protect a specific way

Q58: The marginal tax rate for the first