Multiple Choice

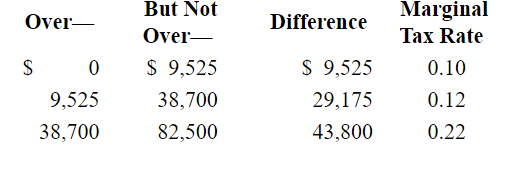

Following is a partial personal taxable income schedule for a single filer:  The average tax rate for a single filer with taxable income of $38,700 would be:

The average tax rate for a single filer with taxable income of $38,700 would be:

A) 10.0%

B) 11.5%

C) 12.0%

D) 17.1%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q57: Business method patents protect a specific way

Q58: The marginal tax rate for the first

Q59: Patents are intellectual property rights granted for

Q60: There are four kinds of patents.

Q61: The type of financing available at a

Q63: In a general partnership, legal action that

Q64: Trademarks are intellectual property rights that allow

Q65: In a corporate legal entity, the personal

Q66: Which of the following is not a

Q67: Partnerships are treated with pass-through taxation. This