Multiple Choice

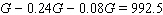

If 24% of your monthly pay is withheld for federal income taxes and another 8% is withheld for Social Security, state income tax, and other miscellaneous items, leaving you with $992.50 a month in take-home pay, then the amount you earned before the deductions were removed from your check is given by the equation  . Solve this equation to find your gross income to the nearest dollar.

. Solve this equation to find your gross income to the nearest dollar.

A) $1,310 per month

B) $1,025 per month

C) $1,460 per month

D) $1,182 per month

E) $1,577 per month

Correct Answer:

Verified

Correct Answer:

Verified

Q48: The cost of a long-distance phone call

Q49: A collection of dimes and quarters has

Q50: The volume of a cylinder is given

Q51: Find the solution for the equation. <img

Q52: Simplify the expression. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8806/.jpg" alt="Simplify the

Q54: Solve the equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8806/.jpg" alt="Solve the

Q55: The width of a rectangle is 4

Q56: Solve. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8806/.jpg" alt="Solve.

Q57: Solve the inequality. Graph the solution set.

Q58: Solve the equation. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8806/.jpg" alt="Solve the