Multiple Choice

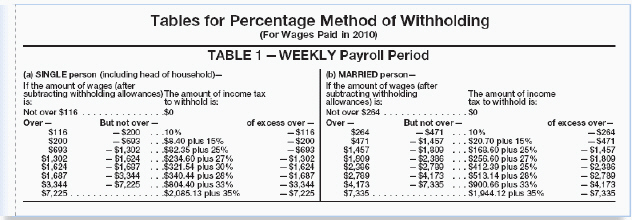

Lewis is single with one allowance. He has gross weekly earnings of $525.00. He can deduct $70.19 from his gross earnings for the allowance. Use the percentage method table to find the amount of weekly federal income tax withheld.

A) $38.22

B) $46.62

C) $74.42

D) $84.95

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Kermit Jacobs is married with 5 allowances.

Q36: Loretta is single with two allowances. Her

Q37: Jackson is married with four allowances. His

Q38: Attus Nasos is married with five allowances.

Q39: Juanita Gonzalez works in an assembly plant.

Q41: In the last four weeks, Case Janson

Q42: The more withholding allowances that Rolanda claims,

Q43: Katelyn works from home assembling craft kits.

Q44: Josiah lives in a state with a

Q45: Tracy works from home entering data into