Short Answer

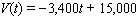

Straight-line depreciation is an accounting method used to help spread the cost of new equipment over a number of years. It takes into account both the cost when new and the salvage value, which is the value of the equipment at the time it gets replaced. The function  where V is value and t is time in years, can be used to find the value of a large copy machine during the first 4 years of use. After how many years will the copier be worth only $7,000? Round your answer to the nearest hundredth.

where V is value and t is time in years, can be used to find the value of a large copy machine during the first 4 years of use. After how many years will the copier be worth only $7,000? Round your answer to the nearest hundredth.  __________ years

__________ years

Correct Answer:

Verified

Correct Answer:

Verified

Q125: The weight of a certain material varies

Q126: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Let and

Q127: Given f ( x ) = x

Q128: For the function <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="For the

Q129: Find the equation of the line parallel

Q131: A company manufactures and sells diskettes for

Q132: The volume of a gas is inversely

Q133: For the function <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="For the

Q134: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Let Evaluate

Q135: Let <img src="https://d2lvgg3v3hfg70.cloudfront.net/TBX8808/.jpg" alt="Let Evaluate