Multiple Choice

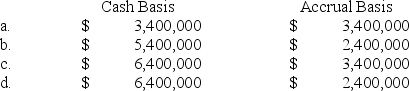

On June 1, Royal Corp. began operating a service company with an initial cash investment by shareholders of $2,000,000. The company provided $6,400,000 of services in June and received full payment in July. Royal also incurred expenses of $3,000,000 in June that were paid in August. During June, Royal paid its shareholders cash dividends of $1,000,000. What was the company's income before income taxes for the two months ended July 31 under the following methods of accounting?

A) Option a

B) Option b

C) Option c

D) Option d

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Owners' equity can be expressed as assets

Q12: The balance in retained earnings at the

Q14: The adjusting entry required to record accrued

Q15: On September 15, 2018, Oliver's Mortuary

Q17: When a business makes an end-of-period adjusting

Q19: The income statement summarizes the operating activity

Q20: Cost of goods sold is:<br>A) An asset

Q21: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2599/.jpg" alt=" -Prepare the closing

Q40: Match the following statements with the best

Q61: Match the following terms with their definitions.<br>-Accounts