Essay

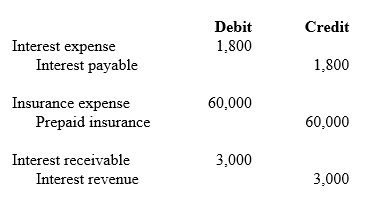

The Yankel Corporation's controller prepares adjusting entries only at the end of the fiscal year. The following adjusting entries were prepared on December 31, 2018:

Additional information:

1. The company borrowed $30,000 on June 30, 2018. Principal and interest are due on June 30, 2019. This note is the company's only interest-bearing debt.

2. Insurance for the year on the company's office buildings is $90,000. The insurance is paid in advance.

3. On August 31, 2018, Yankel lent money to a customer. The customer signed a note with principal and interest at 9% due in one year.

Required:

Determine the following:

1. What is the interest rate on the company's note payable?

2. The 2018 insurance payment was made at the beginning of which month?

3. How much did Yankel lend its customer on August 31?

Correct Answer:

Verified

1. $1,800 represents six months of inter...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2599/.jpg" alt=" -Prepare the closing

Q22: The statement of shareholders' equity discloses the

Q23: The closing process brings all temporary accounts

Q24: Debits increase asset accounts and decrease liability

Q25: Ace Bonding Company purchased merchandise inventory on

Q27: Molly's Auto Detailers maintains its records on

Q28: Which of the following accounts has a

Q29: Making insurance payments in advance is an

Q30: In its first year of operations Acme

Q31: Somerset Leasing received $12,000 for 24 months'