Multiple Choice

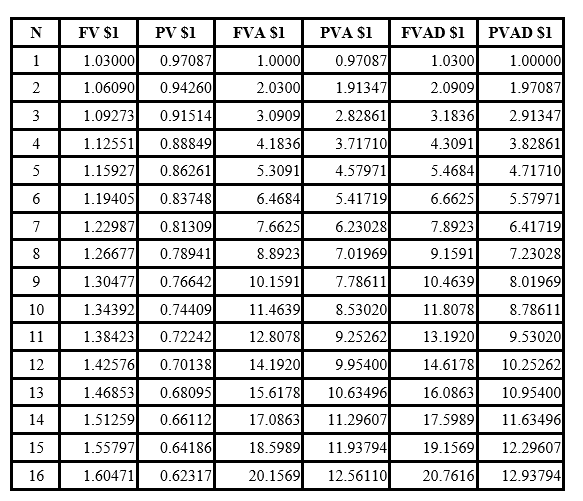

Present and future value tables of $1 at 3% are presented below:

-A firm leases equipment under a long-term lease (analogous to an installment purchase) that calls for 12 semiannual payments of $39,014.40. The first payment is due at the inception of the lease. The annual rate on the lease is 6%. What is the value of the leased asset at inception of the lease?

A) $388,349.

B) $400,000.

C) $454,128.

D) $440,082.

Correct Answer:

Verified

Correct Answer:

Verified

Q116: Briefly describe the differences between an ordinary

Q117: Santa Cruz Oil is obligated to

Q118: Koko Company pays $10 million at the

Q119: Each of the independent situations below describes

Q120: An annuity is a series of equal

Q121: Explain how you would compute the imputed

Q123: An investor purchases a 20-year, $1,000 par

Q124: Below are excerpts from time value of

Q125: George Jones is planning on a cruise

Q126: First Financial Auto Loan Department wishes to