Multiple Choice

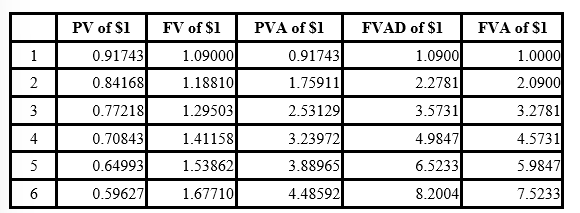

Present and future value tables of $1 at 9% are presented below.

-An investment product promises to pay $42,000 at the end of 10 years. If an investor feels this investment should produce a rate of return of 12%, compounded annually, what's the most the investor should be willing to pay for the investment?

A) $15,146.

B) $13,523.

C) $42,000.

D) $130,446.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: DEF Company will issue $2,000,000 in 10%,

Q3: Present and future value tables of $1

Q4: Present and future value tables of $1

Q5: On January 1, 2018, Bishop Company issued

Q6: DON Corp. is contemplating the purchase of

Q7: Tammy wants to buy a car that

Q8: An annuity consists of level principal payments

Q9: Adam Baum Company borrowed $48,000 from B.

Q10: The calculation of present value eliminates interest

Q11: When interest is compounded, the stated rate