Multiple Choice

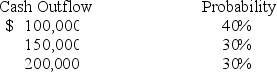

Simpson Mining is obligated to restore leased land to its original condition after its excavation activities are completed in three years. The cash flow possibilities and probabilities for the restoration costs in three years are as follows:  The company's credit-adjusted risk-free interest rate is 5%. The liability that Simpson must record at the beginning of the project for the restoration costs is: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

The company's credit-adjusted risk-free interest rate is 5%. The liability that Simpson must record at the beginning of the project for the restoration costs is: (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

A) $129,576.

B) $145,000.

C) $125,257.

D) $172,768.

Correct Answer:

Verified

Correct Answer:

Verified

Q103: Two banks each have annual CD rates

Q104: Prepare a time diagram for the future

Q105: Determine the price of a $200,000 bond

Q106: To determine the future value factor for

Q107: In the future value of an ordinary

Q109: Samson Inc. is contemplating the purchase of

Q110: On January 1, 2018, Mania Enterprises issued

Q111: Kunkle Company wishes to earn 20% annually

Q112: Present and future value tables of $1

Q113: Reba wishes to know how much would