Essay

The note about debt included in the financial statements of Healdsburg Company for the year ended December 31, 2017 disclosed the following:

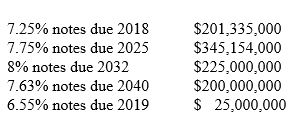

Debt. The following table summarizes the long-term debt of the Company at December 31, 2017. All of the notes were originally issued at their face (maturity) value and have been gradually repaid over time so that these amounts are the remaining balances at this date.

Required: Assuming that the notes pay interest annually and mature on December 31 of the respective years, compute the following:

-Suppose that Healdsburg enters into a sales contract with an auto manufacturer on January 1, 2018, to provide tires that cost Healdsburg $18 million to produce. The buyer offers Healdsburg $6 million in cash and agrees to take over only the principal payment on Healdsburg's 6.55% debt notes. Assume that the going market interest is 7% at the time. What would Healdsburg's gross profit be on the sale?

Correct Answer:

Verified

The revenue would be $6 million + the PV...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Present and future value tables of $1

Q32: Present and future value tables of $1

Q33: Present and future value tables of $1

Q34: GHI Company will issue $2,000,000 in 8%,

Q35: Present and future value tables of $1

Q37: Present and future value tables of $1

Q38: Hillsdale is considering two options for comparable

Q39: Given identical current amounts owed and identical

Q40: A deferred annuity is one in which

Q41: Davenport Inc. offers a new employee a