Essay

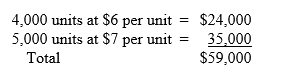

Hazelton Corporation uses a periodic inventory system and the LIFO method to value its inventory. The company began 2018 with $59,000 in inventory of its only product. The beginning inventory consisted of the following layers:

During 2018, 6,000 units were purchased at $8 per unit and during 2019, 7,000 units were purchased at $9 per unit. Sales, in units, were 7,000 and 12,000 during 2018 and 2019, respectively.

Required:

1. Calculate cost of goods sold for 2018 and 2019.

2. Disregarding income tax, determine the LIFO liquidation profit or loss, if any, for 2018 and 2019.

Correct Answer:

Verified

1.

Cost of goods sold:

2018: 1,000 x $7 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Cost of goods sold:

2018: 1,000 x $7 ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2599/.jpg" alt=" -Required: Compute the

Q10: Which of the following is false regarding

Q12: Company A is identical to Company B

Q13: Nueva Company reported the following pretax data

Q15: Net purchases are reduced for discounts taken

Q16: CMN Inc. uses LIFO and has experienced

Q17: The Foxworthy Corporation uses a periodic inventory

Q18: Ramen Inc. adopted dollar-value LIFO (DVL) as

Q19: TNM Inc. uses LIFO and was founded

Q96: Match the following terms with their definitions.<br>-LIFO<br>A)Average