Essay

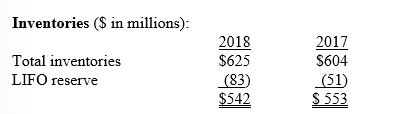

Spando Apparel uses the LIFO inventory method for external reporting and for income tax purposes but maintains its internal records using FIFO. The following disclosure note was included in a recent annual report:

The company's income statement reported cost of goods sold of $3,120 million for the fiscal year ended December 31, 2018.

Required:

1. Spando adjusts the LIFO reserve at the end of its fiscal year. Prepare the December 31, 2018, adjusting entry to record the cost of goods sold adjustment.

2. If Spando had used FIFO to value its inventories, what would cost of goods sold have been for the 2018 fiscal year?

Correct Answer:

Verified

Correct Answer:

Verified

Q34: In a perpetual average cost system:<br>A) A

Q35: In a periodic inventory system, the cost

Q36: The following information is taken from the

Q38: Inventory records for Herb's Chemicals revealed the

Q40: Cinnamon Buns Co. (CBC) started 2018 with

Q41: Purchases equal the invoice amount:<br>A) Plus freight-in,

Q42: The Mateo Corporation's inventory at December 31,

Q43: Listed below are 5 terms followed by

Q44: Inventory records for Herb's Chemicals revealed the

Q96: Match the following terms with their definitions.<br>-LIFO<br>A)Average