Essay

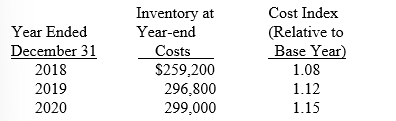

On January 1, 2018, the National Furniture Company adopted the dollar-value LIFO method of computing inventory. An internal cost index is used to convert ending inventory to base year. Inventory on January 1 was $200,000. Year-end inventories at year-end costs and cost indexes for its one inventory pool were as follows:

Required:

Compute inventory amounts at the end of each year.

Correct Answer:

Verified

Ending

Ending Inventory Inventory Layers...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Ending Inventory Inventory Layers...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q79: During periods when costs are rising and

Q80: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2599/.jpg" alt=" -Required: Compute the

Q81: Thompson TV and Appliance reported the following

Q82: A company's estimate of merchandise that will

Q84: Bunker Auto Supply purchased merchandise on January

Q85: In a period when costs are rising

Q86: Shipping charges on outgoing goods are included

Q88: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2599/.jpg" alt=" -Required: Compute the

Q96: Match the following terms with their definitions.<br>-LIFO<br>A)Average

Q159: Match each definition with the correct term