Multiple Choice

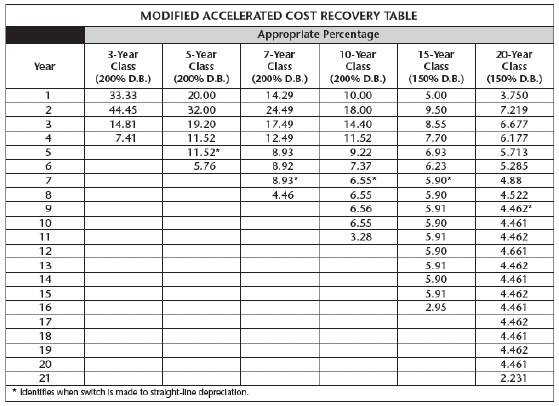

What is the third-year depreciation of a copier that originally cost $3,800? Use the MACRS method.

A) $224.58

B) $437.76

C) $729.60

D) $1,216

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q20: The original cost of a car was

Q21: The life of a microwave is 7

Q22: The life of a semitruck is 11

Q23: The original cost of a wave runner

Q24: What depreciation class is used for the

Q26: If the asset is bought during the

Q27: The original cost of a bus was

Q28: Tammy purchased an office building for a

Q29: The life of a garbage disposal is

Q30: James bought a wave runner at the