Essay

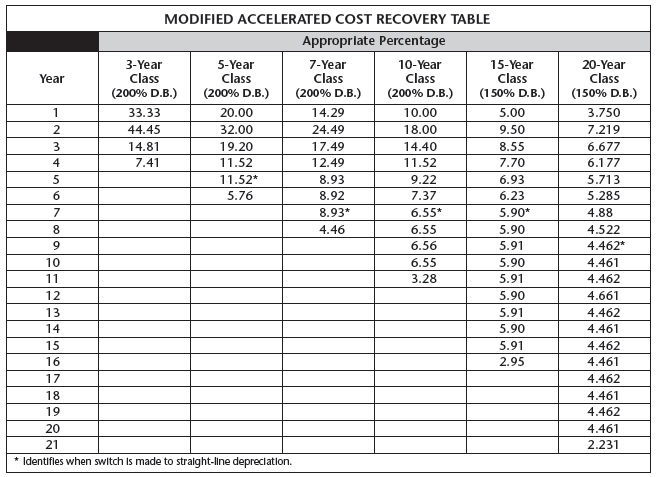

Steven purchased a safe for his office that cost $3,800 and has a salvage value of $1,000. Steven plans to use the safe 95% for business purposes and 5% for personal use. What is the second-year depreciation? Use the MACRS method.

Correct Answer:

Verified

$884.09;

$3,800 * ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$884.09;

$3,800 * ...

$3,800 * ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q4: Jed bought a truck at the beginning

Q5: The depreciation schedule for office furniture is

Q6: The salvage value is deducted when calculating

Q7: Julie bought a boat at the beginning

Q8: The life of a dishwasher is 6

Q10: When adding all annual depreciation, the total

Q11: The life of a refrigerator is

Q12: The life of a car is 5

Q13: What is the sixth-year depreciation of a

Q14: The original cost of a jet ski