Short Answer

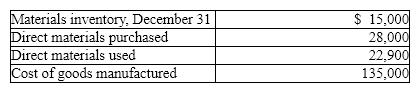

Taylor Industries had a fire and some of its accounting records were destroyed. Available information is presented below for the year ended December 31.

Additional information:

Factory overhead is 150% of direct labor cost.

Finished goods inventory decreased by $18,000 during the year.

Work in process inventory increased by $12,000 during the year.

Calculate:

(a) Materials inventory, January 1

(b) Direct labor cost

(c) Factory overhead incurred

(d) Cost of goods sold

Correct Answer:

Verified

(a) Materials inventory, January 1 = $15...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Conversion costs are<br>A) direct materials and direct

Q19: Sustainability is the practice of operating a

Q19: Goods that are partially completed by a

Q47: For an automotive repair shop, the wages

Q95: Which of the following is an example

Q118: Watson Company has the following data: <img

Q151: The cost of a manufactured product generally

Q167: Planning is the process of developing the

Q177: The phases of the management process are

Q198: Goods that are part way through the