Short Answer

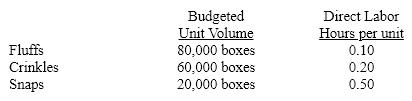

Bugaboo Co. manufactures three types of cookies: Fluffs, Crinkles, and Snaps. The production process is relatively simple, and factory overhead costs are allocated to products using a single plantwide factory rate based on direct labor hours. Information for the month of May, Bugaboo's first month of operations, follows:

Bugaboo has budgeted direct labor costs for May at $8.50 per hour. Budgeted direct materials costs for May are: Fluffs, $0.75/unit; Crinkles $0.40/unit; and Snaps $0.30/unit.

Bugaboo's budgeted overhead costs for May are:

Assume that Bugaboo sells all the boxes it produces in May.

(a) Compute Bugaboo's plantwide factory overhead rate for May.

(b) Compute the product cost in May for each type of cookie.

(c) Does Bugaboo's use of a plantwide factory overhead rate in any way distort the product costs for May?

Correct Answer:

Verified

(c) A much higher overhead...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(c) A much higher overhead...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: The Roget Factory has determined that its

Q29: When a plantwide factory overhead rate is

Q47: Shanghai Company sells glasses,fine china,and everyday dinnerware.They

Q74: Multiple production department factory overhead rates are

Q100: Transformations Hair Salon uses an activity-based costing

Q101: Adirondak Marketing Inc. manufactures two products, A

Q102: Condelezza Co. manufactures two products, A and

Q105: The Aleutian Company produces two products, Rings

Q107: Challenger Factory produces two similar products -

Q109: Panamint Systems Corporation is estimating activity costs