Short Answer

Tulip Company produces two products, T and U. The indirect labor costs include the following two items:

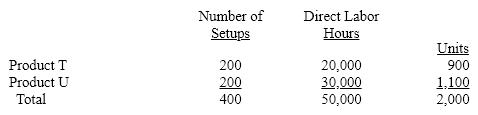

The following activity-base usage and unit production information is available for the two products:

(a) Determine the single plantwide factory overhead rate, using direct labor hours as the activity base.

(b) Determine the factory overhead cost per unit for Products T and U, using the single plantwide factory overhead rate.

(c) Determine the activity rate for plant supervision and setup labor, assuming that the activity base for supervision is direct labor hours and the activity base for setup labor is number of setups.

(d) Determine the factory overhead cost per unit for Products T and U, using activity-based costing.

(e) Why is the factory overhead cost per unit different for the two products under the two methods?

Correct Answer:

Verified

(e) The factory overhead cost pe...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(e) The factory overhead cost pe...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: The Anazi Leather Company manufactures leather handbags

Q24: Service companies can effectively use single facility-wide

Q28: Blackwelder Factory produces two similar products -

Q29: The Beauty Beyond Words Salon uses an

Q33: The Dawson Company manufactures small lamps and

Q33: Managers depend on accurate factory overhead allocation

Q34: The Skagit Company manufactures Hooks and Nooks.

Q36: The Kaumajet Factory produces two products -

Q54: The Sawtooth Leather Company manufactures leather handbags

Q92: Managers depend on product costing to make