Your Company Purchases a New Delivery Van For for Tax Purposes, the Van Will Be Depreciated Over

Multiple Choice

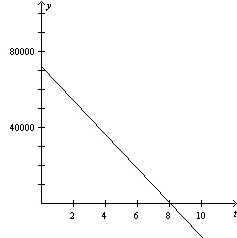

Your company purchases a new delivery van for . For tax purposes, the van will be depreciated over a seven year period. At the end of seven years, the value of the van is expected to be $9000 . The graph relating the depreciated value of the van, y , to the number of years, t , since it was purchased is shown below. What is the y- intercept of the graph, if any?

A) 53,000

B) 72,000

C)

D)

E) no y- intercept

Correct Answer:

Verified

Correct Answer:

Verified

Q98: Determine if the point (-4,-3) is

Q99: A business purchases a van for

Q100: Estimate the slope of the line

Q101: Write an equation of the line

Q102: Write the equation <span class="ql-formula"

Q104: Write an equation in slope-intercept form

Q105: Write the equation <span class="ql-formula"

Q106: State if the line passing through

Q107: A caterer charges $939 to cater

Q108: Determine which of the ordered pairs