Essay

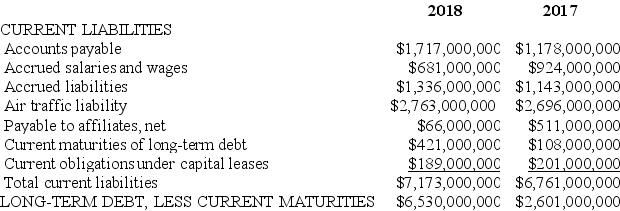

In its 2018 annual report to shareholders, Border Airlines Inc. presented the following balance sheet information about its liabilities:  In addition, Border presented the following among its note disclosures:

In addition, Border presented the following among its note disclosures:

Maturities of long-term debt (including sinking fund requirements) for the next five years are: 2019 - $421 million; 2020 - $212 million; 2021 - $273 million; 2022 - $1.0 billion; 2023 - $777 million.

Required:

Consider the appropriate classification of these long-term debt obligations. Assuming no more long-term debt will be issued, what are the implications of the information above for Border's liquidity and solvency risk in 2018 and the following years?

Correct Answer:

Verified

Because some of the debt is being reclas...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q71: A contingent loss should be reported in

Q72: Branch Company, a building materials supplier, has

Q73: Which of the following is not a

Q74: On January 1, 2018, G Corporation agreed

Q75: The following selected transactions relate to liabilities

Q77: Identify the major components included in the

Q78: Panther Co. had a quality-assurance warranty liability

Q79: Expense for a quality-assurance warranty is recorded

Q80: Diversified Industries sells perishable electronic products. Some

Q81: What is the effective interest rate (rounded)