Essay

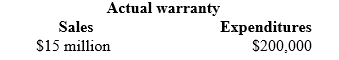

Fusion, Inc. introduced a new line of circuits in 2018 that carry a four-year warranty against manufacturer's defects. Based on experience with previous product introductions, warranty costs are expected to approximate 3% of sales. Sales and actual warranty expenditures for the first year of selling the product were:

Required:

1. Does this situation represent a loss contingency? Why or why not? How should it be accounted for?

2. Prepare journal entries that summarize sales of the circuits (assume all credit sales) and any aspects of the warranty that should be recorded during 2018.

3. What amount should Fusion report as a liability at December 31, 2018?

Correct Answer:

Verified

1.

This is a loss contingency. There may...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

This is a loss contingency. There may...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q137: On November 1, 2018, Ziegler Products issued

Q138: Which of the following is true about

Q139: An extended warranty typically results in the

Q140: Clark's Chemical Company received refundable deposits on

Q141: Sunnyvale Computer Company sells a line of

Q143: Concept 1 Office Products sells office electronics

Q144: The cost of promotional offers should be

Q145: State and Federal Unemployment Taxes (SUTA and

Q146: On October 31, 2018, Simeon Builders borrowed

Q147: On November 1, 2018, a $216,000, 9-month,