Multiple Choice

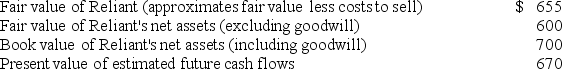

Kingston Corporation has $95 million of goodwill on its books from the 2016 acquisition of Reliant Motors. At the end of its 2018 fiscal year, management has provided the following information for its required goodwill impairment test ($ in millions) :  Assuming that Reliant is considered a reporting unit for U.S. GAAP and a cash-generating unit for IFRS, the amount of goodwill impairment loss that Kingston should recognize according to U.S. GAAP and IFRS, respectively, is:

Assuming that Reliant is considered a reporting unit for U.S. GAAP and a cash-generating unit for IFRS, the amount of goodwill impairment loss that Kingston should recognize according to U.S. GAAP and IFRS, respectively, is:

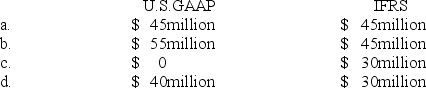

A) option A

B) option B

C) option C

D) option D

Correct Answer:

Verified

Correct Answer:

Verified

Q208: On September 30, 2018, Morgan, Inc. acquired

Q209: An impairment loss has the effect of:<br>A)

Q210: Property, plant, and equipment and finite-life intangible

Q211: Archie Co. purchased a framing machine for

Q212: An asset acquired January 1, 2018,

Q214: On March 31, 2018, M. Belotti purchased

Q215: In the first year of an asset's

Q216: On June 30, 2018, Prego Equipment purchased

Q217: Listed below are five terms followed by

Q218: Asset C3PO has a depreciable base of