Essay

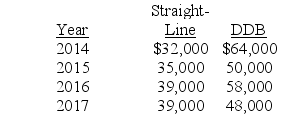

Gonzaga Company has used the double-declining-balance method for depreciation since it started business in 2014. At the beginning of 2018, the company decided to change to the straight-line method. Depreciation as reported and what it would have been reported if the company had always used straight-line is listed below:  Required:

Required:

What journal entry, if any, should Gonzaga make to record the effect of the accounting change (ignore income taxes)? Explain.

Correct Answer:

Verified

The change in depreciation method is tre...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: Which of the following typically refers to

Q38: Accounting for impairment losses:<br>A) Involves a two-step

Q39: The replacement of a major component increased

Q40: Intangible assets that have an indefinite useful

Q41: In testing for recoverability of property, plant,

Q43: At the end of its 2018 fiscal

Q44: Weaver Textiles Inc. has used the straight-line

Q45: Nature Power Company uses the composite method

Q46: Accounting for a change in the estimated

Q47: On September 30, 2018, Bricker Enterprises purchased