Essay

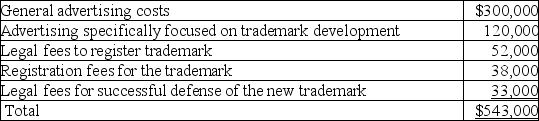

A company had the following expenditures related to developing its trademark.  During your year-end review of the accounts related to intangibles, you discover that the company has capitalized all the above as costs of the trademark. Management contends that all of the costs increase the value of the trademark; therefore, all the costs should be capitalized.

During your year-end review of the accounts related to intangibles, you discover that the company has capitalized all the above as costs of the trademark. Management contends that all of the costs increase the value of the trademark; therefore, all the costs should be capitalized.

Required:

1. Which of the above costs should the company capitalize to the Trademark account in the balance sheet?

2. Which of the above costs should the company report as expense in the income statement?

Correct Answer:

Verified

Correct Answer:

Verified

Q130: On April 23, 2018, Trevors Mining

Q131: El Dorado Foods Inc. owns a chain

Q132: Depreciation, depletion, and amortization:<br>A) All refer to

Q133: Short Corporation acquired Hathaway, Inc., for $52,000,000.

Q134: On April 1, 2018, Parks Co. purchased

Q136: The legal life of a patent is:<br>A)

Q137: Kelly Company and its subsidiaries are engaged

Q138: Advocates of accelerated depreciation methods argue that

Q139: On June 30, 2018, Prego Equipment purchased

Q140: On January 1, 2018, Hobart Mfg. Co.