Essay

Tweet Inc. included the following disclosure note in an annual report:

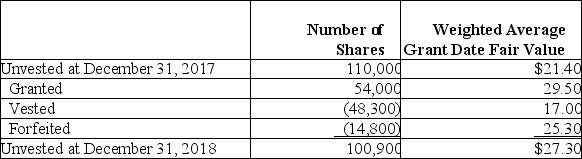

Share-Based Compensation (in part)

compensation expense related to these grants is based on the grant date fair value of the RSUs and is recognized on a straight-line basis over the applicable three-year vesting period.

The following table summarizes the activities for our unvested RSUs for the year ended December 31, 2018:  Required:

Required:

(1.) Ignoring taxes, determine compensation expense Tweet reported in the year ended December 31, 2019, for the restricted stock units granted during the year ended December 31, 2018.

(2.) Based on the information provided in the disclosure note, prepare the journal entry that summarizes the vesting of RSUs during the year ended December 31, 2018. (Tweet's common shares have a par amount per share of $0.01.)

Correct Answer:

Verified

1. $29.50 54,000 shares = $1,593,000

The...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q117: On January 1, 2018, D Corp. granted

Q118: Under IFRS, a deferred tax asset for

Q119: When a company's income statement includes discontinued

Q120: Basic earnings per share is computed using:<br>A)

Q121: On December 31, 2017, Jackson Company had

Q124: Rice Inc. had 420 million shares of

Q125: If a company reports discontinued operations, EPS

Q126: Under its executive stock option plan, N

Q127: At December 31, 2018 and 2017, Cow

Q221: Listed below are 5 terms followed by