Essay

A disclosure note from E Corp.'s 2018 annual report is shown below:

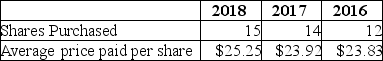

Employee Stock Purchase Plan. We have an employee stock purchase plan for all eligible employees. Compensation expense for the employee stock purchase plan is recognized in accordance with GAAP. Shares of our common stock may be purchased by employees at three-month intervals at 85% of the fair value on the last day of each three-month period. Employees may purchase shares having a value not exceeding 10% of their gross compensation during an offering period. Employees purchased the following shares:  At June 30, 2018, 150 million shares were reserved for future issuance.

At June 30, 2018, 150 million shares were reserved for future issuance.

Required:

Describe the way "Compensation expense for the employee stock purchase plan" is recognized in accordance with GAAP by E Corp. Include in your explanation the journal entry that summarizes employee share purchases during 2018.

Correct Answer:

Verified

A disclosure note from E Corp.'s 2018 an...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q212: On January 1, 2018, Wendy Day Co.

Q213: Listed below are five terms followed by

Q214: Jet Corporation had 8 million shares of

Q215: Taxon Corp. granted restricted stock units (RSUs)

Q216: On January 1, 2018, Jeans-R-Us Company awarded

Q218: At December 31, 2018, Hansen Corporation had

Q219: Executive stock options:<br>A) allow the holder the

Q220: Hammerstein Corporation offers a variety of share-based

Q221: On December 31, 2017, Jackson Company had

Q222: If previous experience indicates that a material