Essay

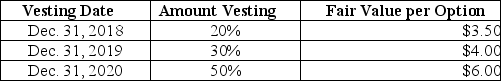

Pastner Brands is a calendar-year firm with operations in several countries. As part of its executive compensation plan, at January 1, 2018, the company had issued 20 million executive stock options permitting executives to buy 20 million shares of stock for $25. The vesting schedule is 20% the first year, 30% the second year, and 50% the third year (graded-vesting). The fair value of the options is estimated as follows:  Required:

Required:

Determine the compensation expense related to the options to be recorded each year for 2018-2020, assuming Pastner prepares its financial statements in accordance with International Financial Reporting Standards (IFRS).

Correct Answer:

Verified

The compensation cost is allo...

The compensation cost is allo...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: Listed below are five terms followed by

Q37: A primary goal of earnings per share

Q38: Wilson Inc. developed a business strategy that

Q39: Kramer Inc. had 95 million shares of

Q40: On January 2, 2018, L Co. issued

Q42: During 2018, Angel Corporation had 900,000 shares

Q43: On January 1, 2018, Felix Austead Athletic

Q44: Listed below are five terms followed by

Q45: The Peach Corporation provides restricted stock to

Q46: Under its executive stock option plan, Z