Multiple Choice

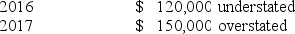

During 2018, P Company discovered that the ending inventories reported on its financial statements were incorrect by the following amounts:  P uses the periodic inventory system to ascertain year-end quantities that are converted to dollar amounts using the FIFO cost method. Prior to any adjustments for these errors and ignoring income taxes, P's retained earnings at January 1, 2018, would be:

P uses the periodic inventory system to ascertain year-end quantities that are converted to dollar amounts using the FIFO cost method. Prior to any adjustments for these errors and ignoring income taxes, P's retained earnings at January 1, 2018, would be:

A) Correct.

B) $30,000 overstated.

C) $150,000 overstated.

D) $270,000 overstated.

Correct Answer:

Verified

Correct Answer:

Verified

Q104: Regardless of the type of accounting change

Q105: A change that uses the prospective approach

Q106: Annual depreciation expense on a building purchased

Q107: We record and report most changes in

Q108: What is the difference between U.S. GAAP

Q110: Which of the following is not a

Q111: Using International Financial Reporting Standards (IFRS), which

Q112: Gore Inc. recorded a liability in 2018

Q113: Moonland Company's income statement contained the following

Q114: JFS Co. changed from straight-line to double-declining-balance