Essay

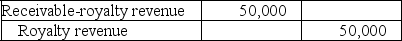

Johnson Company receives royalties on a patent it developed several years ago. Royalties are 5% of net sales, to be received on September 30 for sales from January through June and receivable on March 31 for sales from July through December. The patent rights were distributed on July 1, 2017, and Johnson accrued royalty revenue of $50,000 on December 31, 2017, as follows:  Johnson received royalties of $65,000 on March 31, 2018, and $90,000 on September 30, 2018. In December, 2018, the patent user indicated to Johnson that sales subject to royalties for the second half of 2018 should be $600,000.

Johnson received royalties of $65,000 on March 31, 2018, and $90,000 on September 30, 2018. In December, 2018, the patent user indicated to Johnson that sales subject to royalties for the second half of 2018 should be $600,000.

Required:

Prepare any journal entries Johnson should record during 2018 related to the royalty revenue.

Correct Answer:

Verified

Correct Answer:

Verified

Q84: A company changes depreciation methods. Briefly describe

Q85: Green Company overstated its inventory by $50

Q86: Hepburn Company bought a copyright for $90,000

Q87: Colorado Consulting Company has been using the

Q88: Early in 2018, Benton Well Supplies discovered

Q90: C. Good Eyeglasses overstated its inventory by

Q91: In December 2018, Kojak Insurance Co. received

Q92: B Co. reported a deferred tax liability

Q93: If inventory is understated at the end

Q94: Which of the following is not a