Essay

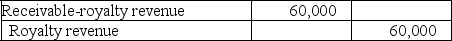

Mattson Company receives royalties on a patent it developed several years ago. Royalties are 5% of net sales, to be received on September 30 for sales from January through June and receivable on March 31 for sales from July through December. The patent rights were distributed on July 1, 2017, and Mattson accrued royalty revenue of $60,000 on December 31, 2017, as follows:  Mattson received royalties of $65,000 on March 31, 2018, and $80,000 on September 30, 2018. In December, 2018, the patent user indicated to Mattson that sales subject to royalties for the second half of 2018 should be $800,000.

Mattson received royalties of $65,000 on March 31, 2018, and $80,000 on September 30, 2018. In December, 2018, the patent user indicated to Mattson that sales subject to royalties for the second half of 2018 should be $800,000.

Required:

(1.) Prepare any journal entries Mattson should record during 2018 related to the royalty revenue.

(2.) What changes should be made to retained earnings relative to these royalties?

Correct Answer:

Verified

(1.)  (2.) The fact that more ...

(2.) The fact that more ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q140: Retrospective restatement usually is not used for

Q141: Goosen Company bought a copyright for $90,000

Q142: Berkshire Inc. uses a periodic inventory system.

Q143: Companies should report the cumulative effect of

Q144: Indicate the nature of each of the

Q146: Prior years' financial statements are restated when

Q147: Which of the following statements is true

Q148: Berkshire Inc. uses a periodic inventory system.

Q149: For 2017, P Co. estimated its two-year

Q150: Describe briefly the approaches of reporting changes