Multiple Choice

Use the following to answer questions

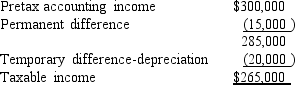

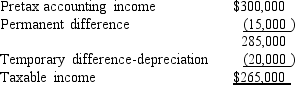

For its first year of operations,Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:

Tringali's tax rate is 40%.Assume that no estimated taxes have been paid.

Tringali's tax rate is 40%.Assume that no estimated taxes have been paid.

-

Tringali's tax rate is 40%.

What should Tringali report as its deferred income tax liability as of the end of its first year of operations?

A) $35,000.

B) $20,000.

C) $14,000.

D) $ 8,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Changes in enacted tax rates that do

Q59: Financial statement disclosure of the components of

Q87: Which of the following differences between financial

Q104: Pocus, Inc., reports warranty expense when related

Q137: A reconciliation of pretax financial statement income

Q138: Listed below are five independent situations.For each

Q140: For classification purposes,a valuation allowance:<br>A)Is allocated proportionately

Q141: North Dakota Corporation began operations in January

Q159: Deferred tax assets and liabilities typically are

Q160: During the current year, Stern Company had