Multiple Choice

Use the following to answer questions

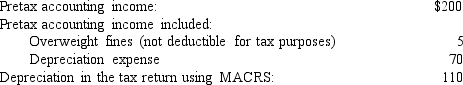

The following information relates to Franklin Freightways for its first year of operations (data in millions of dollars) :

The applicable tax rate is 40%.There are no other temporary or permanent differences.

The applicable tax rate is 40%.There are no other temporary or permanent differences.

-Franklin's net income ($ in millions) is:

A) $134.

B) $124.

C) $119.4.

D) $118.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Roberts Corp. reports pretax accounting income of

Q55: Future taxable amounts result in deferred tax

Q57: Listed below are five independent situations.For each

Q60: A net operating loss (NOL)carryforward cannot result

Q62: The Kelso Company had the following operating

Q64: What would Kent's income tax expense be

Q94: Under current tax law a net operating

Q97: A magazine publisher collects one year in

Q120: Which of the following causes a temporary

Q174: If a company's deferred tax asset is