Essay

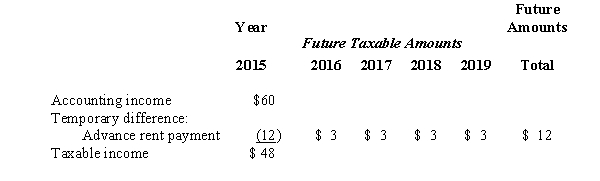

The following information is for James Industries' first year of operations.Amounts are in millions of dollars.

In 2016 the company's pretax accounting income was $67.The enacted tax rate for 2015 and 2016 is 40%,and it is 35% for years after 2016.

Required:

Prepare a journal entry to record the income tax expense for the year 2016.Show well-labeled computations for income tax payable and the change in the deferred tax account.

Correct Answer:

Verified

Correct Answer:

Verified

Q15: A deferred tax asset represents the tax

Q101: Which of the following differences between financial

Q140: For classification purposes,a valuation allowance:<br>A)Is allocated proportionately

Q141: North Dakota Corporation began operations in January

Q143: What should Kent report as the current

Q147: At December 31,2016,Moonlight Bay Resorts had the

Q148: Prepare two disclosure notes for Typical's year

Q149: A reconciliation of pretax financial statement income

Q150: Why are differences in reported amounts for

Q150: Four independent situations are described below.Each involves