Multiple Choice

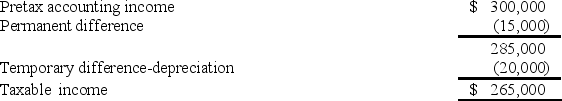

For its first year of operations, Tringali Corporation's reconciliation of pretax accounting income to taxable income is as follows:  Tringali's tax rate is 40%. Assume that no estimated taxes have been paid.

Tringali's tax rate is 40%. Assume that no estimated taxes have been paid.

-What should Tringali report as its deferred income tax liability as of the end of its first year of operations?

A) $35,000.

B) $20,000.

C) $14,000.

D) $8,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q58: The following information relates to Franklin Freightways

Q59: Financial statement disclosure of the components of

Q60: Listed below are 5 terms followed by

Q61: Under current tax law, generally a net

Q62: The Bell Company had the following operating

Q64: Listed below are 5 terms followed by

Q65: Four independent situations are described below. Each

Q66: What events create permanent differences between accounting

Q67: Information for Kent Corp. for the year

Q68: Recognizing tax benefits in a loss year