Multiple Choice

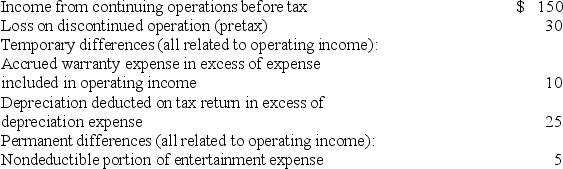

Information for Hobson Corp. for the current year ($ in millions) :  The applicable enacted tax rate for all periods is 40%.

The applicable enacted tax rate for all periods is 40%.

-How should Hobson report tax on the discontinued operation?

A) A tax receivable of $12 million in the balance sheet.

B) A tax benefit of $12 million to net against the $30 million pretax loss.

C) A deferred tax asset of $12 million in the balance sheet.

D) None of these answer choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Roberts Corp. reports pretax accounting income of

Q6: GAAP regarding accounting for income taxes requires

Q7: Listed below are 5 terms followed by

Q8: The financial reporting carrying value of Boze

Q9: Rent collected in advance results in deferred

Q11: What is the justification for a corporation

Q12: According to GAAP for accounting for income

Q13: The information that follows pertains to Julia

Q14: Which of the following differences between financial

Q15: A deferred tax asset represents the tax