Essay

In LMC's 2018 annual report to shareholders, it disclosed the following information about its income taxes:

INCOME TAXES

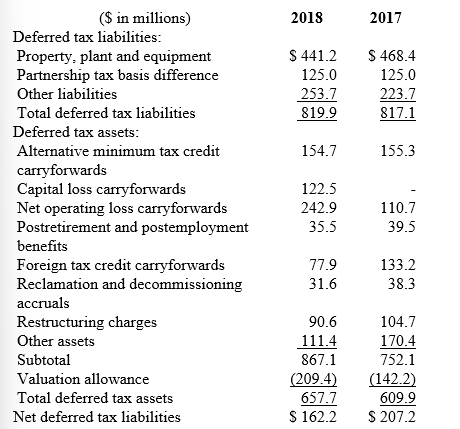

Deferred income taxes reflect the net tax effects of temporary differences between the amounts of assets and liabilities for accounting purposes and the amounts used for income tax purposes.

Significant components of the Company's deferred tax liabilities and assets as of December 31 were as follows:

-Explain why LMC has a $209.4 million valuation allowance for its deferred tax assets.

Correct Answer:

Verified

Apparently, it is more likely than not t...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: Listed below are five independent situations. For

Q122: Listed below are 5 terms followed by

Q123: A deferred tax asset represents a:<br>A) Future

Q124: Listed below are 5 terms followed by

Q125: Wayne Co. had a decrease in deferred

Q127: Pocus Inc. reports warranty expense when related

Q128: Of the following temporary differences, which one

Q129: A reconciliation of pretax financial statement income

Q130: The effect of a change in tax

Q131: Sometimes a temporary difference will produce future