Essay

In LMC's 2018 annual report to shareholders, it disclosed the following information about its income taxes:

INCOME TAXES

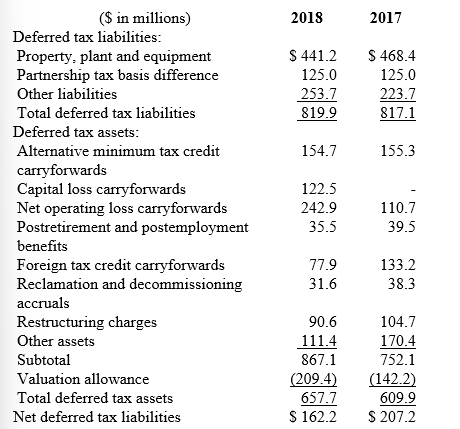

Deferred income taxes reflect the net tax effects of temporary differences between the amounts of assets and liabilities for accounting purposes and the amounts used for income tax purposes.

Significant components of the Company's deferred tax liabilities and assets as of December 31 were as follows:

-Indicate why LMC lists net operating loss carryforwards as a component of deferred tax assets.

Correct Answer:

Verified

LMC has generated tax carryforwards from...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: Isaac Inc. began operations in January 2018.

Q29: Puritan Corp. reported the following pretax accounting

Q30: How are deferred tax assets arising from

Q31: Madison Company has taken a position in

Q32: Valuation allowances reduce deferred tax liabilities to

Q34: In its first three years of operations

Q35: For the current year ($ in millions),

Q36: A reconciliation of pretax financial statement income

Q37: Brook Company has taken a position on

Q38: The following information relates to Franklin Freightways