Essay

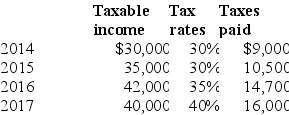

Tobac Company reported an operating loss of $132,000 for financial reporting and tax purposes in 2018. The enacted tax rate is 40% for 2018 and all future years. Assume that Tobac elects a loss carryback. No valuation allowance is needed for any deferred tax assets. Taxable income, tax rates, and income taxes paid in Tobac's first four years of operations were as follows:  Required:

Required:

1.) Prepare a compound journal entry to record Tobac's tax provision for the year 2018. Show well-labeled computations.

2.) Compute Tobac's net loss for 2018.

Correct Answer:

Verified

Deferred tax asset from NOL...

Deferred tax asset from NOL...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q135: Estimated employee compensation expenses earned during the

Q136: The following information relates to Franklin Freightways

Q137: In its first four years of operations

Q138: In 2017, HD had reported a deferred

Q139: Listed below are five independent situations. For

Q141: At December 31, 2018, Moonlight Bay Resorts

Q142: Listed below are five independent situations. For

Q143: Which of the following statements is true

Q144: For its first year of operations, Tringali

Q145: EZ, Inc., reports pretax accounting income of