Essay

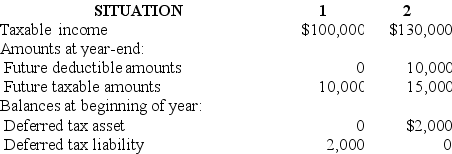

Two independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:  The enacted tax rate is 40% for both situations.

The enacted tax rate is 40% for both situations.

Required:

For each situation determine the:

(a.) Income tax payable currently.

(b.) Deferred tax asset - balance at year-end.

(c.) Deferred tax asset change dr or (cr) for the year.

(d.) Deferred tax liability - balance at year-end.

(e.) Deferred tax liability change dr or (cr) for the year.

(f.) Income tax expense for the year.

Correct Answer:

Verified

Correct Answer:

Verified

Q70: For classification purposes, a valuation allowance:<br>A) Is

Q71: Which of the following creates a deferred

Q72: Which of the following usually results in

Q73: In reconciling net income to taxable income,

Q74: Information for Kent Corp. for the year

Q76: In its first four years of operations

Q77: In 2018, Magic Table Inc. decides to

Q78: Plutonic Inc. had $400 million in taxable

Q79: Several years ago, Western Electric Corp. purchased

Q80: Four independent situations are described below. Each