Multiple Choice

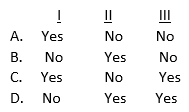

The financial statements of KCP America, a U.S. entity, are prepared for inclusion in the consolidated financial statements of its non-U.S. parent. These financial statements are prepared in conformity with the accounting principles generally accepted in the parent's country and are for use only in that country. How may KCP America's auditor report on these financial statements?

A) A U.S.-style report (unmodified) . II. A U.S.-style report modified to report on the accounting principles of the parent's country. III. The report form of the parent's country.

B) Option A

C) Option B

D) Option C

E) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q178: Which of the following factors most likely

Q179: An auditor ordinarily uses a working trial

Q180: For a nonissuer, a control deficiency would

Q181: To obtain an understanding of a continuing

Q182: On the basis of audit evidence gathered

Q184: Which of the following procedures would an

Q185: A CPA firm should establish procedures for

Q186: After obtaining an understanding of internal control

Q187: An auditor is considering whether the omission

Q188: A registration statement filed with the SEC