Multiple Choice

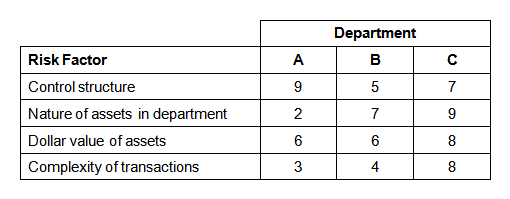

A bank uses a risk analysis matrix to quantify the relative risk of auditable entities. The analysis involves rating auditable entities on risk factors using a scale of 1 to 10, with 10 representing the greatest risk. A partial list of risk factors and the ratings given to three of the bank's departments is provided below:  Which of the following statements regarding risk in the department is true?

Which of the following statements regarding risk in the department is true?

A) As compared to departments A and C, department B has a stronger control system to compensate for the greater complexity of the department's transactions and dollar value of its assets.

B) The internal audit activity should schedule audits of department B more often than audits of department C because of the relative control strength of department C as compared to department B.

C) The nature of department A's control structure may be justified by the nature of the department's assets and the complexity of its transactions.

D) The relative ranking of the departments in order of their risk, from greatest to least risk, is: A; C; B.

Correct Answer:

Verified

Correct Answer:

Verified

Q258: According to the International Professional Practices Framework,

Q259: What is the primary reason for having

Q260: According to IIA guidance, which of the

Q261: Which of the following would not be

Q262: According to IIA guidance, which of the

Q264: The chief audit executive (CAE) decided that

Q265: An audit of a company's accounts payable

Q266: Which of the following controls in a

Q267: According to IIA guidance, which of the

Q268: While developing a risk based audit plan,