Multiple Choice

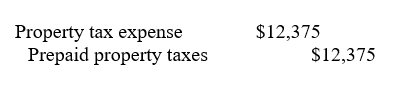

Eldora, Inc. paid property taxes of $16,500 on June 30, 2012, for the period July 1, 2012, to June 30, 2013, and debited prepaid property tax expense. Eldora, Inc. uses a fiscal year end of September 30 for financial purposes. What is the adjusting entry Eldora, Inc. should make on September 30, 2012?

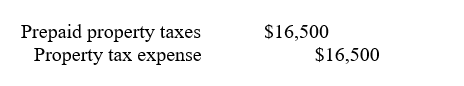

A)

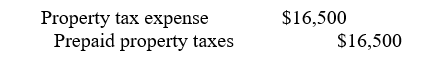

B)

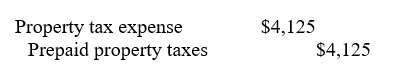

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Fonda Company's fiscal year is the calendar

Q9: Which of the following is the liability

Q10: The following information relates to the defined

Q11: Gribble's fiscal year is the calendar year.

Q12: Marino, Inc. makes a sale and collects

Q14: Bernal Company laid off 10 employees during

Q15: Which of the following taxes is NOT

Q16: Gowrie, Inc. began operations on January 1,

Q17: Prepaid Property Taxes would typically appear on

Q18: A large investment fund of stocks and