Multiple Choice

On June 1, Jenni invested $4,000 into a mutual fund. By December 31, the value of the mutual fund had decreased to $3,200. Jenni did not sell any portion of the mutual fund during the year. Assuming Jenni's income tax rate on this investment will be 35%, the journal entry to record the income tax expense is

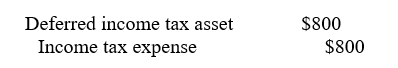

A)

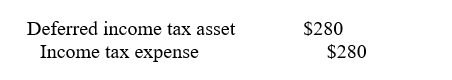

B)

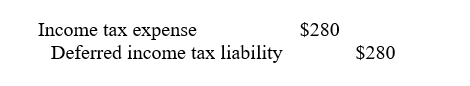

C)

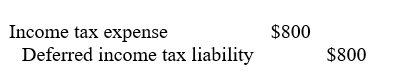

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q50: Indicate the appropriate accounting treatment for each

Q51: Which of the following is the proper

Q52: The earnings from assets in a company's

Q53: Indicate whether the following independent expenditures should

Q54: When managers are compensated based on the

Q56: Which accounting principle requires that the expense

Q57: During the first week of January, Nathan

Q58: Assante Corporation reported the following data for

Q59: Which of the following types of contingencies

Q60: What effect does an extraordinary item have