Multiple Choice

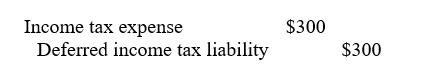

On June 1, Jenni invested $4,000 into a mutual fund. By December 31, the value of the mutual fund had increased to $5,200. Jenni did not sell any portion of the mutual fund during the year. Assuming Jenni's income tax rate on this investment will be 25%, the journal entry to record the income tax expense is

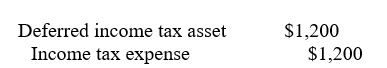

A)

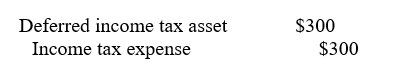

B)

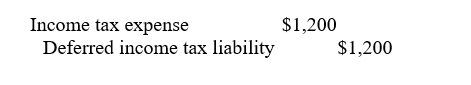

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q40: A contingent liability is recorded by making

Q41: The accounting term for an uncertain circumstance

Q42: A footnote disclosure only is required if

Q43: Which of the following is NOT a

Q44: When the right to purchase stock in

Q46: Which of the following events would be

Q47: On December 31, the trial balance of

Q48: Deferred income taxes arise from<br>A) Differences between

Q49: Which of the following is NOT true

Q50: Indicate the appropriate accounting treatment for each