Multiple Choice

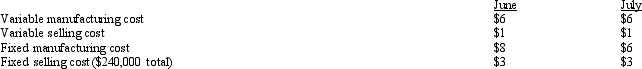

Exhibit 20-6 Vilas Company manufactured 80,000 units during July but only sold 65,000 of these units at a price of $20 each. At the beginning of the month, Vilas had 5,000 units in finished goods inventory. The following unit costs are known for June and July: Vilas Company uses the first-in first-out (FIFO) method.

Vilas Company uses the first-in first-out (FIFO) method.

Refer to Exhibit 20-6. What is net income for July using the absorption costing method?

A) $205,000

B) $85,000

C) $215,000

D) $125,000

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Maintaining too little inventory causes all but

Q19: When calculating ROI on inventory, inventory turnover

Q20: Creasly Company has an economic order quantity

Q21: What type of firm could have work-in-process

Q22: When comparing balance sheets, which type of

Q24: Financial holding cost in a merchandising firm

Q25: During the first quarter of 2011, Dewey

Q26: Exhibit 20-5 Barron Company manufactured 150,000 units

Q27: Hannafin Company decreased the size of inventory

Q28: Exhibit 20-6 Vilas Company manufactured 80,000 units