Essay

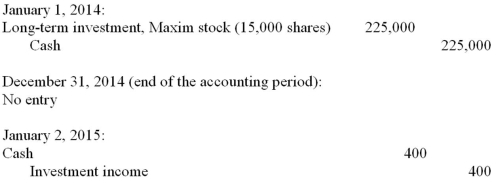

On January 1, 2014, Alden Company acquired 15,000 shares of the nonvoting common stock of Maxim Corporation as a long-term investment. Maxim reported a 2014 net income of $35,000. On January 2, 2015, Maxim declared and paid a $10,000 cash dividend. The fair value of the Maxim stock held by Alden on December 31, 2014, was $224,000. Alden Company has recorded only the following journal entries:  Required:

Required:

Based on the above information, answer the following questions:

A. What method did Alden use to account for the investment?

B. Did Alden fail to make an adjusting entry on December 31, 2014?

C. What condition, if changed, would require that the equity method be used?

D. Assuming the fair value method is used; calculate the valuation of the net investment on January 3, 2015.

Correct Answer:

Verified

A. Fair value method, as is indicated by...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: An unrealized holding loss is reported on

Q18: On January 31, 2014, McBurger Corporation purchased

Q19: On January 1, 2014, Sheldon Company paid

Q20: During 2014, the following items were

Q26: Orleans Corporation purchased 1,000,000 shares of Creole

Q28: Phillips Corporation purchased 1,000,000 shares of Martin

Q39: The use of consolidation accounting for a

Q91: Miller Corp. purchased $1,000,000 of bonds at

Q108: An investment accounted for under the equity

Q110: A realized gain or loss is reported